Four Ways Your Home Equity Can Work for You in Delaware

If you own a home in Delaware, there’s a strong chance you’ve built meaningful equity over the past several years.

From beach properties in Sussex County to established neighborhoods in Wilmington and Newark, Delaware homeowners have benefited from steady appreciation and strong buyer demand.

And that built-up equity? It can open doors.

How Much Equity Do Delaware Homeowners Have?

Equity grows as:

You pay down your mortgage

Your home increases in value

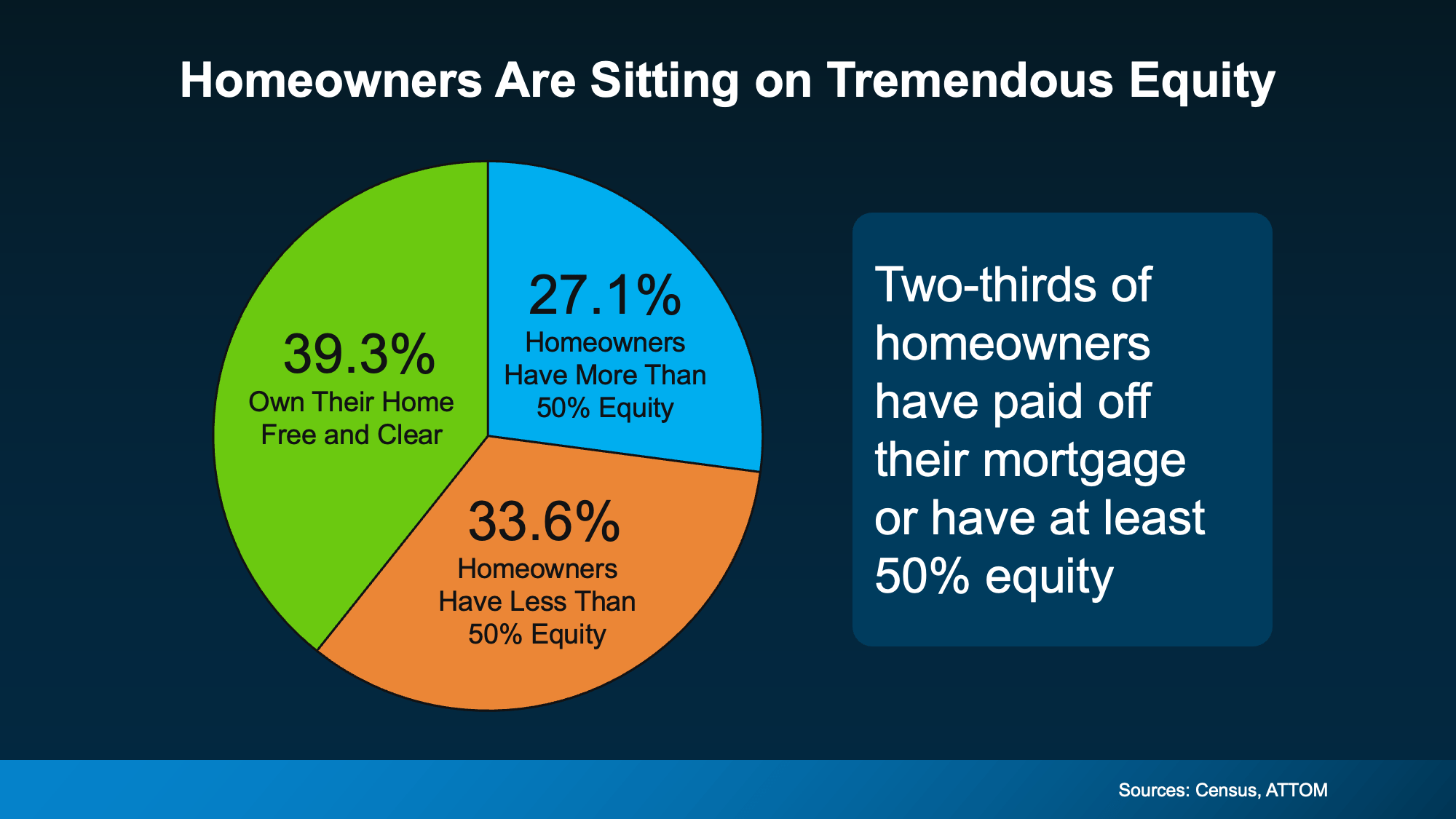

Nationally:

39% of homeowners own their homes free and clear

27% have at least 50% equity

The typical homeowner has nearly $300,000 in equity

With continued demand in areas like Wilmington, Newark, Rehoboth Beach, and throughout Sussex County, many Delaware homeowners are sitting on significant untapped potential.

Four Ways Your Home Equity Can Work for You in Delaware

1. Move Into a Home That Matches Your Next Chapter

Whether you’re:

Downsizing after retirement

Moving closer to the beach

Upsizing for a growing family

Relocating within Delaware

Your equity can provide the flexibility to make that move with confidence.

2. Improve the Home You Love

Not ready to leave Delaware? Consider reinvesting.

Popular upgrades in this market include:

Coastal-style kitchen remodels

Outdoor entertaining areas

Energy-efficient upgrades

Bathroom renovations

Strategic improvements can boost long-term value — especially in desirable beach and suburban communities.

3. Reach Financial Milestones

Your equity can help fund:

College tuition

A new business

Investment opportunities

Helping family members buy their first home

For many Delaware residents, homeownership has quietly built long-term wealth.

4. Create Options During Financial Stress

If you ever face financial hardship, equity provides flexibility.

Selling your home in today’s market may allow you to walk away with cash rather than facing foreclosure.

What Should You Do Next?

If you’re thinking about leveraging your equity:

Step 1: Get a personalized equity estimate from a Delaware real estate expert.

Step 2: Meet with a financial advisor to evaluate your options.

Be sure to maintain at least 20% equity in your home as a financial buffer.

Bottom Line for Delaware Homeowners

From Wilmington to the beaches of Sussex County, your home equity could be your biggest financial opportunity.

If you had access to a portion of your equity right now — what would you use it for?