Why So Many Delaware Homeowners Are Downsizing Right Now

Across Delaware, more homeowners are reaching a moment of reflection — retirement is no longer a distant milestone, but an approaching reality.

According to Realtor.com and Census data, nearly 12,000 people will turn 65 each day over the next two years. With 15% planning to retire in 2026 and another 23% in 2027, many Delaware residents are starting to think carefully about where — and how — they want to live next.

Why Downsizing Makes Sense in Delaware

Delaware has long been a popular destination for retirees, and it’s easy to see why: lower property taxes, coastal living, and communities designed with lifestyle in mind.

For homeowners already living here, downsizing often means shifting from maintaining a large family home to enjoying a space that supports the next phase of life.

Retirees are looking for homes that feel:

Easier to manage

More comfortable day-to-day

Better aligned with how they live now

Single-level homes, townhomes, and low-maintenance communities throughout Delaware are becoming especially appealing.

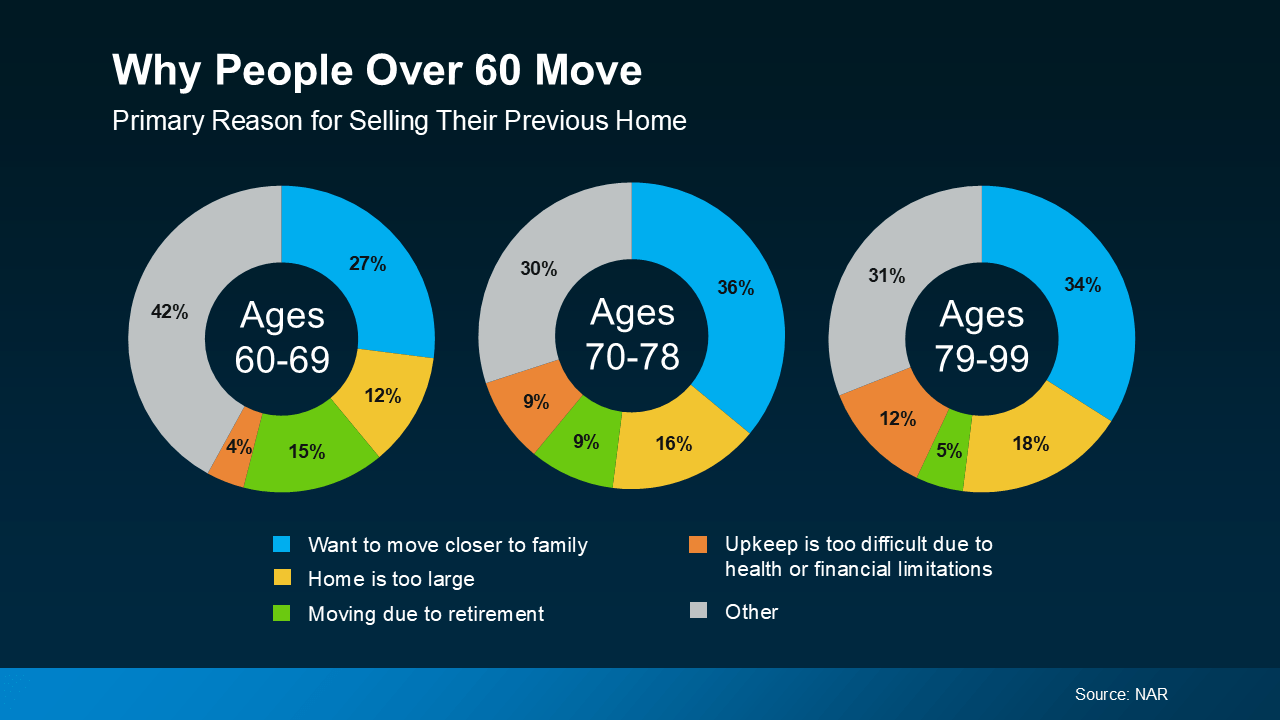

Why People Over 60 Are Choosing to Move

The National Association of Realtors highlights the same core motivations nationwide — and they ring especially true in Delaware:

Moving closer to family and long-time friends

Choosing smaller, more accessible homes

Retiring and gaining the freedom to live anywhere

Reducing monthly costs tied to maintenance and utilities

Downsizing isn’t about loss — it’s about designing a lifestyle that feels lighter, calmer, and more intentional.

Home Equity Is Making Downsizing Possible

Many Delaware homeowners are surprised to learn how strong their financial position actually is.

According to Cotality, the average homeowner has roughly $299,000 in equity, and long-term homeowners often have significantly more. Years of appreciation combined with reduced mortgage balances create flexibility — even in today’s market.

That equity can mean:

Purchasing a smaller home with less debt

Lowering monthly expenses

Unlocking funds for travel, hobbies, or peace of mind

Bottom Line for Delaware Homeowners

Downsizing isn’t about rushing into retirement — it’s about planning it on your terms.

If retirement is approaching and you’re curious what your current home could help you do next, start with information, not pressure.

A conversation about your goals, equity, and options can bring clarity — and help you decide what the next chapter in Delaware should look like.