🦀 Four Ways Your Home Equity Can Work for You in Maryland

If you own a home in Maryland — especially in the Baltimore area — chances are you’re sitting on more equity than you realize.

From historic rowhomes in Baltimore City to waterfront properties along the Chesapeake Bay and growing suburbs like Columbia and Towson, home values across Maryland have built serious wealth for homeowners over the past several years.

And that equity? It’s more than just a number on paper. It’s a powerful financial tool.

How Much Equity Do Maryland Homeowners Have?

As you pay down your mortgage and property values appreciate, the portion of your home you own outright grows. That’s your equity.

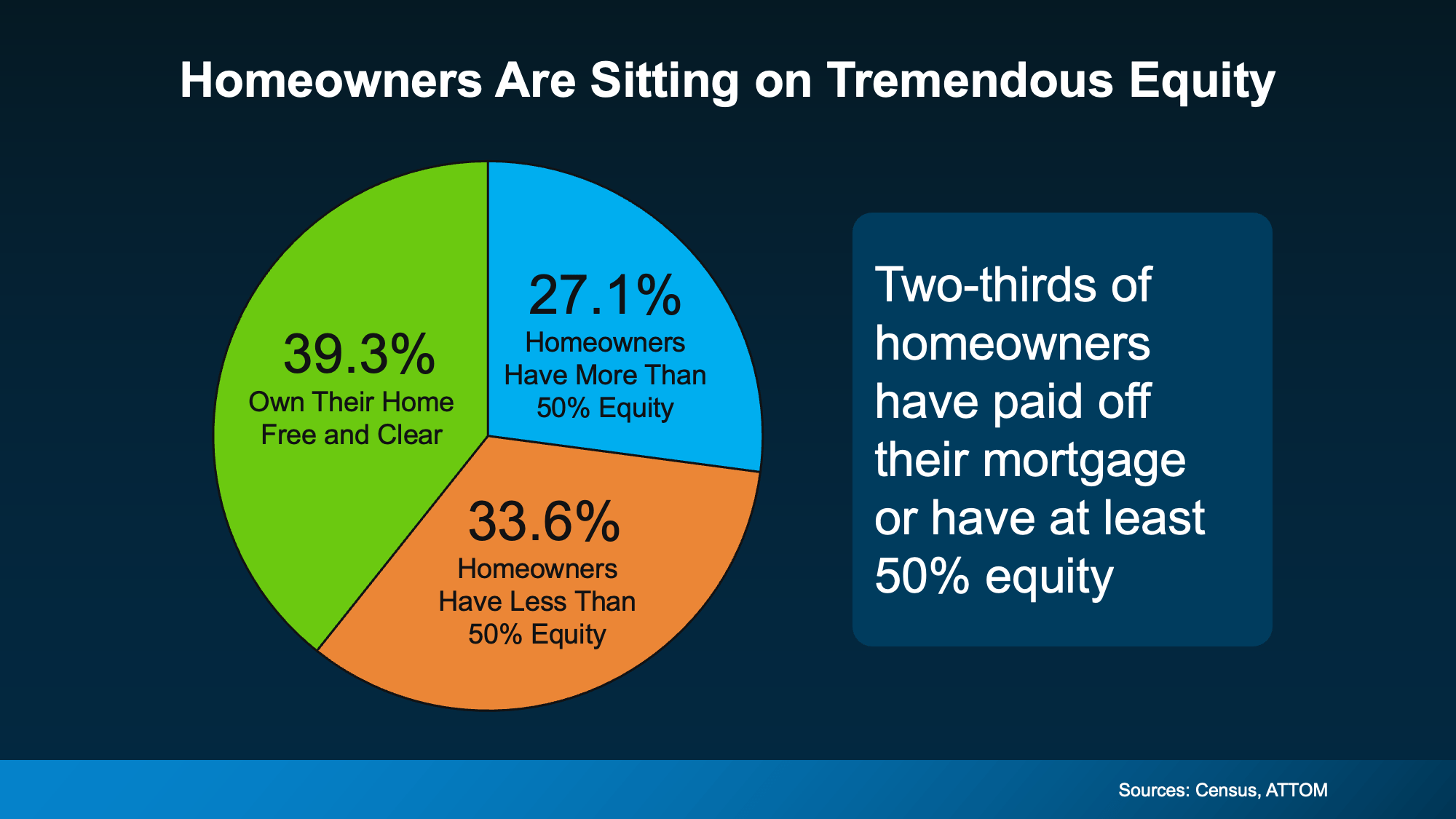

National data shows:

39% of homeowners own their homes outright

27% have at least 50% equity

And the typical homeowner nationally has nearly $300,000 in equity.

Given Maryland’s strong property values — especially in areas like Baltimore, Columbia, Annapolis, and Towson — many local homeowners are in an even stronger position.

So what can you do with it?

Four Ways Your Home Equity Can Work for You in Maryland

1. Move Into a Home That Better Fits Your Life

Maybe you're looking to:

Move from the city to the suburbs

Downsize from a large family home

Upgrade to a waterfront property

Relocate closer to DC for work

Your equity can serve as a substantial down payment — and in some cases, Maryland homeowners have enough equity to purchase their next home outright.

2. Upgrade Your Current Home

If you love your location but not your layout, reinvesting in your home could be the right move.

In the Baltimore market, projects like:

Kitchen renovations

Bathroom upgrades

Finished basements

Outdoor living spaces

can significantly increase value.

Before starting renovations, consult a local real estate expert who understands what buyers in your specific Maryland neighborhood are looking for.

3. Fund a Major Life Goal

Equity can also help you:

Launch a business

Help a child with college tuition

Assist family with a down payment

Prepare for retirement

For many Maryland homeowners, their property has become their largest financial asset.

4. Avoid Foreclosure in Tough Times

If financial hardship hits, your equity can provide options.

Rather than facing foreclosure, many homeowners in Maryland can sell and walk away with money in hand — something that wasn’t possible for many during the 2008 crash.

Your Next Steps

If you're curious about your equity:

Step 1: Request a personalized equity assessment from a local Maryland real estate professional.

Step 2: Speak with a financial advisor to explore your best options.

A good rule of thumb? Maintain at least 20% equity in your home as a financial cushion.

Bottom Line for Maryland Homeowners

From Baltimore City to the Chesapeake Bay, your home equity may be one of your most powerful financial tools.

If you had access to a portion of your equity today — what goal would you pursue?