Why So Many Baltimore Homeowners Are Downsizing Right Now

For many longtime Baltimore homeowners, retirement is no longer a “someday” plan — it’s starting to feel very real.

According to Realtor.com and the U.S. Census Bureau, nearly 12,000 Americans will turn 65 every day over the next two years. Data also shows that about 15% plan to retire in 2026, with another 23% following in 2027.

If you live in Baltimore City or the surrounding counties and retirement is on your radar, now is the time to start thinking intentionally about what comes next.

Why Downsizing Is a Smart Move for Many Baltimore Homeowners

Retirement isn’t just a financial shift — it’s a lifestyle one. And for many people, downsizing isn’t about “having less.” It’s about living better.

In Baltimore, where many homeowners have lived in the same property for decades, larger rowhomes and multi-level houses can start to feel like more work than joy.

What retirees often want instead is a life that feels:

Easier to maintain

Easier to move through

Easier to enjoy

That’s why we’re seeing a growing interest in smaller homes, condos, and townhomes across neighborhoods like Locust Point, Federal Hill, Canton, and surrounding suburban areas.

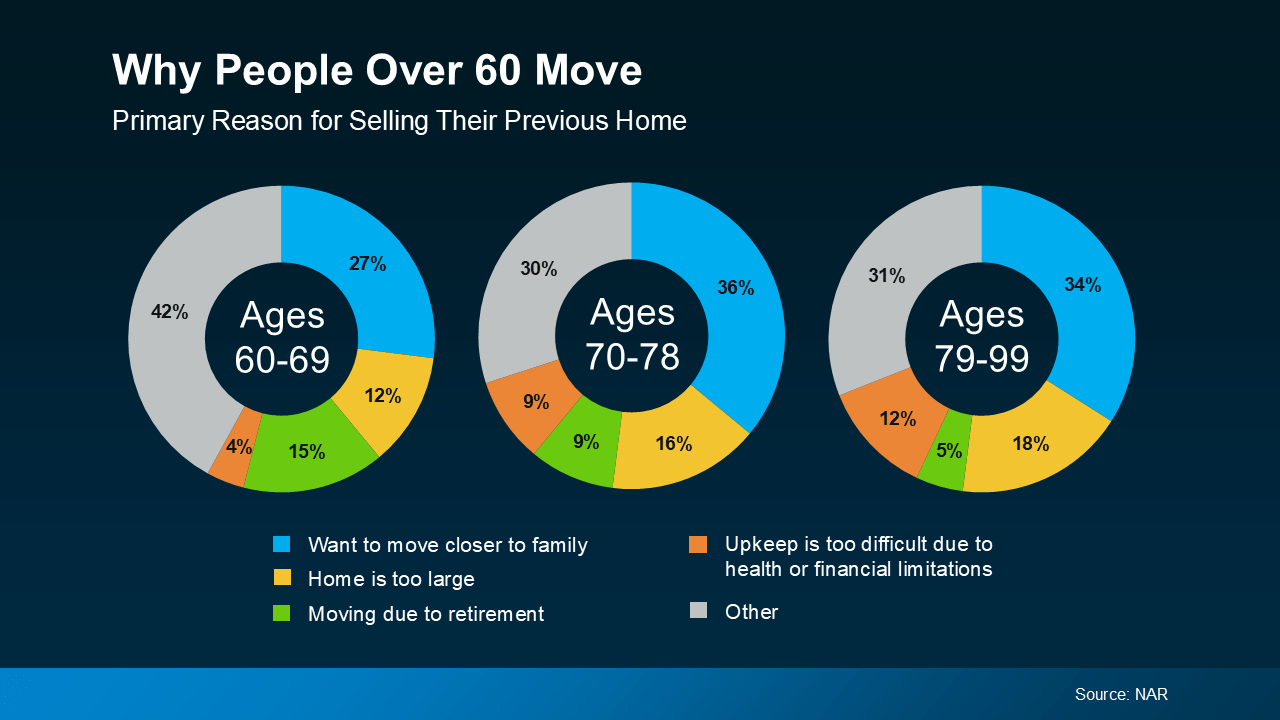

Why People Over 60 Are Moving

According to the National Association of Realtors, the top reasons homeowners over 60 move aren’t about chasing the market — they’re about quality of life:

Being closer to children, grandchildren, or long-time friends

Choosing homes with fewer stairs and less maintenance

Retiring and no longer needing to live near work

Reducing monthly expenses like utilities, insurance, and upkeep

The common theme? Downsizing isn’t giving something up — it’s gaining control and peace of mind.

The Equity Advantage for Baltimore Homeowners

Here’s what’s making downsizing especially possible right now.

Thanks to long-term appreciation in Maryland home values, many Baltimore homeowners are sitting on far more equity than they realize. According to Cotality, the average homeowner has about $299,000 in equity, and for those who’ve owned their home for years, that number is often much higher.

Over time:

Your home value increases

Your mortgage balance shrinks (or disappears)

That combination opens doors — whether it’s buying a smaller home outright, reducing monthly costs, or freeing up funds for retirement.

Bottom Line for Baltimore Homeowners

Downsizing isn’t about the years behind you — it’s about preparing your home for the years ahead.

If you’re starting to wonder what your Baltimore home (and your equity) could make possible, the first step isn’t selling. It’s understanding your options.

A simple, no-pressure conversation can help you decide if downsizing makes sense — and what that next chapter could look like.